The Ultimate Guide To Personal Loans copyright

Table of ContentsThe smart Trick of Personal Loans copyright That Nobody is DiscussingThings about Personal Loans copyrightWhat Does Personal Loans copyright Mean?The 5-Minute Rule for Personal Loans copyrightTop Guidelines Of Personal Loans copyright

For some loan providers, you can inspect your eligibility for a personal funding via a pre-qualification process, which will reveal you what you might get without denting your credit report. To guarantee you never ever miss out on a financing repayment, take into consideration establishing autopay if your loan provider offers it. In some instances, you might also obtain an interest rate price cut for doing so.This consists of:: You'll need to verify you have a job with a consistent earnings so that you can pay back a financing., and other details.

The Best Strategy To Use For Personal Loans copyright

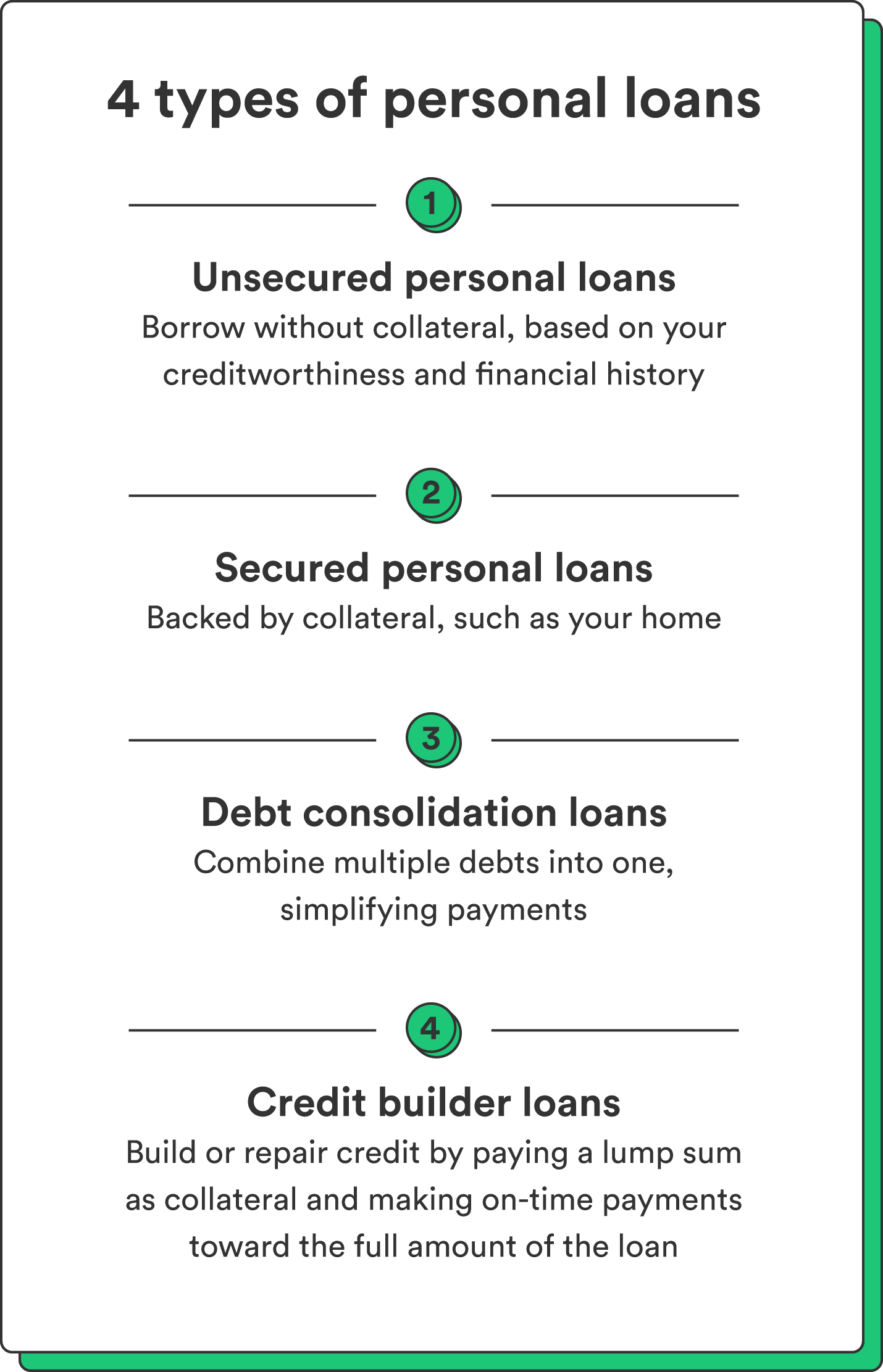

A fair or poor credit rating rating may restrict your alternatives. Personal finances additionally have a few fees that you need to be prepared to pay, including an source cost, which is used to cover the cost of processing your funding. Some lenders will let you pre-qualify for a financing before submitting a real application.

This is not a hard credit report draw, and your credit history and history aren't influenced. A pre-qualification can aid you extract lending institutions that won't offer you a loan, but not all lenders provide this alternative. You can compare as many lending institutions as you 'd like with pre-qualification, in this way you only need to finish a real application with the lender that's most likely going to authorize you for an individual loan.

The greater your credit report, the most likely you are to get the most affordable rates of interest used. The reduced your score, the more challenging it'll be for you to certify for a funding, and also if you do, you can end up with a rate of interest rate on the higher end of what's provided.

All about Personal Loans copyright

Autopay lets you set it and forget it so you never ever have to fret regarding missing out on a car loan payment.

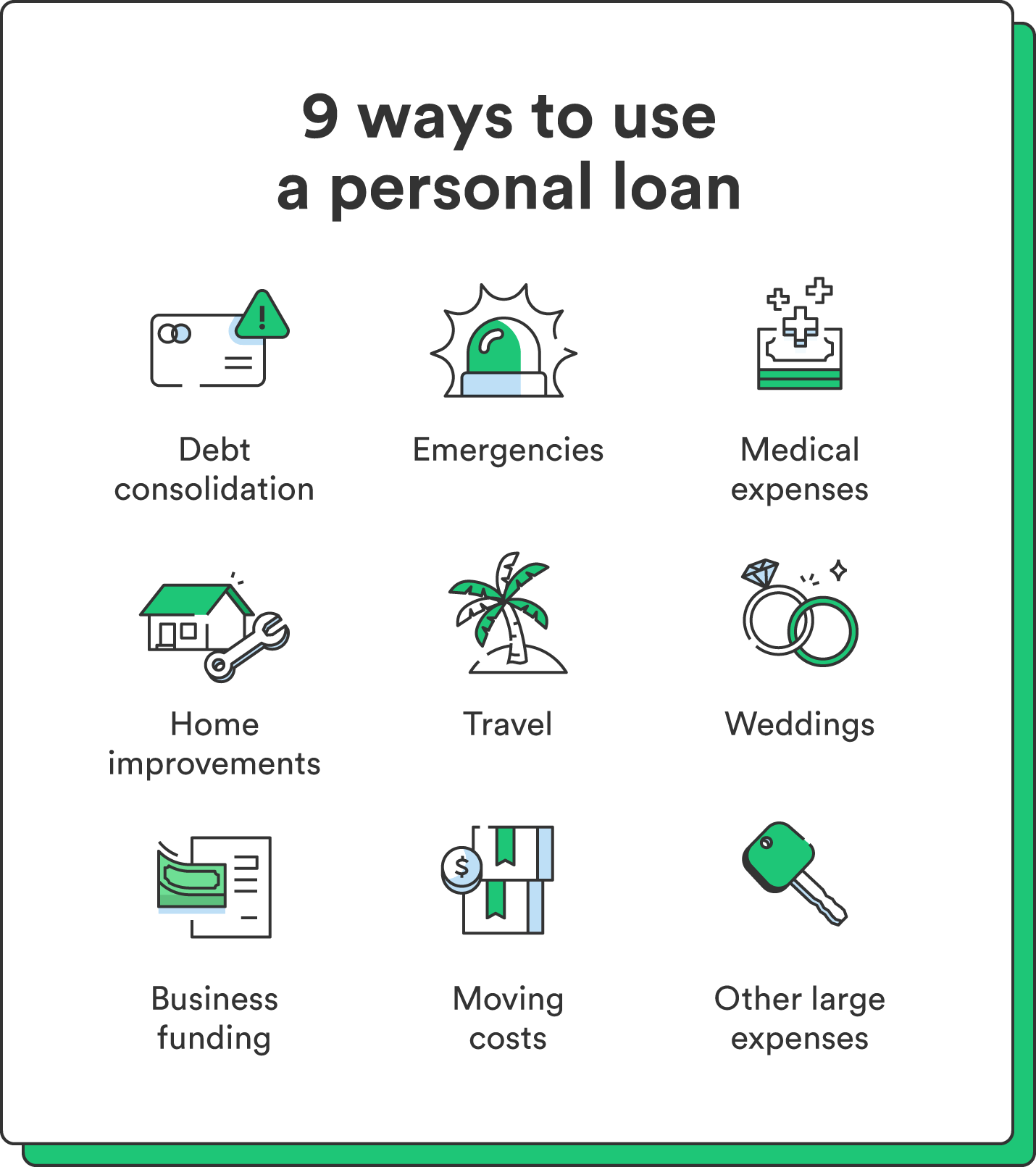

The debtor does not have to report the amount obtained on the financing when filing tax obligations. Nonetheless, if the finance is forgiven, it is thought about a canceled financial obligation and can be taxed. Investopedia commissioned a national survey of 962 united state grownups between Aug. 14, 2023, to Sept. 15, 2023, that had actually taken out an individual funding to learn how they utilized their finance earnings and exactly how they could utilize future personal finances.

Both individual lendings and charge card are 2 alternatives to borrow cash up front, yet they have different objectives. Consider what you need the cash for prior to you select your settlement alternative. There's no incorrect selection, but one can be far more pricey than the other, relying on your needs.

But they aren't for every person. If you don't have excellent credit rating, you may require to get the help of a co-signer who consents to your car loan terms together with you, tackling the legal obligation to pay for the financial debt if you're not able to. If you do not have a co-signer, you might receive an individual finance with poor or fair credit score, yet you might not have as several options contrasted to somebody with good or excellent credit rating.

How Personal Loans copyright can Save You Time, Stress, and Money.

A credit history of 760 and up (excellent) is most likely to get you the least expensive rates of interest readily available for your loan. Consumers with credit history of 560 or below are more probable to have trouble getting better financing terms. That's because with a lower credit history, the interest price often tends to be expensive to make an individual loan a practical borrowing alternative.

Some factors carry more weight than others. 35% of a FICO rating (the page kind used by 90% of the lending institutions in the nation) is based on review your repayment background. Lenders desire to make certain you can manage lendings sensibly and will check out your past behavior to get a concept of how liable you'll remain in the future.

In order to keep that section of your rating high, make all your repayments promptly. Being available in 2nd is the amount of charge card debt impressive, relative to your credit scores limitations. That accounts for 30% of your credit rating and is recognized in the industry as the credit rating utilization proportion.

The lower that proportion the better. The length of your credit report, the kind of credit rating you have and the variety of new credit score applications you have just recently loaded out are the various other aspects that identify your credit history. Outside of your credit score, lenders check out your earnings, job history, fluid properties and the quantity of complete financial debt you have.

Facts About Personal Loans copyright Uncovered

The higher your income and assets and the reduced your various other debt, the better you look in their eyes. Having a great credit report when making an application for an individual lending is very important. It not only identifies see page if you'll obtain authorized but how much interest you'll pay over the life of the financing.

Comments on “Little Known Facts About Personal Loans copyright.”